- Son Dakika

- Gündem

- Ekonomi

- Finans

- Yazarlar

- Sektörel

- Kültür-Sanat

- Dünya

- Teknoloji

- FOTOĞRAF GALERİSİ

- VİDEO GALERİSİ

- e-Gazete

Gelişmelerden haberdar olmak için İstanbul Ticaret Haberleri uygulamasını indirin

Turkey’s Investment Incentives scheme is specifically designed to foster investments with the potential to reduce dependency on the import of intermediary level goods vital to the country’s strategic sectors. Primary objectives of the new investment incentives scheme are as follows:

reduce the current account deficit, boost investment support for lesser developed regions, increase the level of support tools, promote clustering activities, and support investments that will enable technology transfer.

4 MAIN SCHEMES FOR INCENTIVES

Effective as of January 1, 2012, the new investment incentives system sets out the following four schemes: for use by local and international investors:

1. General Investment Incentives Scheme

2. Regional Investment Incentives Scheme

3. Large-Scale Investment Incentives Scheme

4. Strategic Investment Incentives Scheme

1- GENERAL INVESTMENT INCENTIVES SCHEME

Regardless of the investment locality, all projects meeting both the specific capacity conditions and the minimum fixed investment amount are supported within the framework of the General Investment Incentives Scheme. Some types of investments are not eligible for the investment incentives system and would not benefit from this scheme.

The minimum fixed investment amount isTRY1 million in Region 1 and 2, and TRY 500,000 in Regions 3, 4, 5 and 6. Major investment incentive instruments are:

* Exemption from customs duties: Customs tax exemption for imported machinery and equipment for projects with an investment incentive certificate.

* VAT exemption: VAT exemption for imported or domestically purchased machinery and equipment for projects with an investment incentive certificate.

The supportinstrumentsto be provided within the framework of the various investment incentives schemes are shown in the following table:

*Provided that the investment is made in Region 6.

*Provided that the investment is made in Region 6.

**Provided that the investment is made in Regions 3, 4, 5 or 6 within the framework of the Regional Investment Incentives Scheme.

***For construction expenditures of strategic investments with a minimum fixed investment amount of TRY 500 million.

2- REGIONAL INVESTMENT INCENTIVES SCHEME

The sectors to be supported in each region are determined in accordance with regional potential and the scale of the local economy, while the intensity of support varies depending on the level of development in the region.

The minimum fixed investment amount is defined separately for each sector and region with the lowest set at TRY 1 million for Regions 1 and 2, andTRY500,000 for the remaining regions.

The terms and rates of support provided within the Regional Investment Incentives Scheme are shown in the following table.

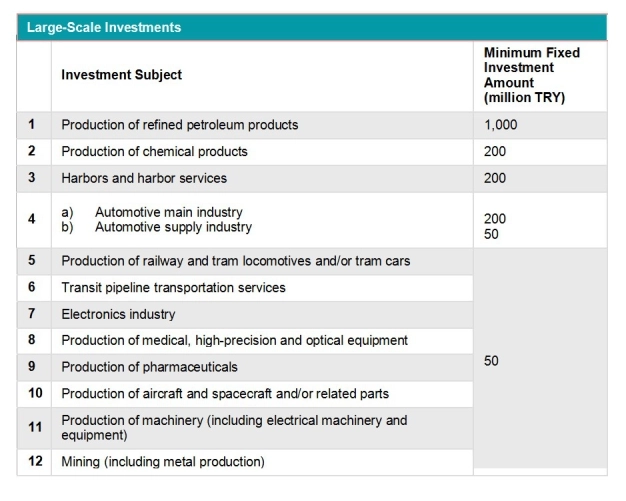

3- LARGE-SCALE INVESTMENT INCENTIVES SCHEME

12 investment topics that have potential to foster Turkey’s technology,

R&D capacity and competitiveness are supported by Large-Scale Investment Incentives Scheme instruments.

4- STRATEGIC INVESTMENT INCENTIVES SCHEME

4- STRATEGIC INVESTMENT INCENTIVES SCHEME

Investments meeting the criteria below are supported within the framework of the Strategic Investment Incentives Scheme:

PRIORITY AREAS

The new investment incentives system defines certain investment areas as “priority” and offers them the regional support extended to Region 5 by the Regional Investment Incentives Scheme, regardless of the region of the investment.If the fixed investment amount in priority investments is TRY 1 billion or more, tax reduction will be applied by adding 10 points on top of the “rate of contribution to investment” available in Region 5.If priority investments are made in Region 6, the regional incentives available for this particular region shall apply.

Fields of investment with specific priorities to be supported with Region 5 instruments regardless of the investment’s region are:

FOR MORE DETAILS PLEASE GO TO: www.invest.gov.tr